Probate Administration is the legal process that occurs when someone passes away. It involves validating the will, if there is one, paying off creditors, and distributing assets according to their wishes or state law. It can be this simple or it can be exceptionally complex if there is a high value of assets, multiple properties, or a dispute amongst heirs.

Why Probate?

We believe every decedent’s estate should pass through probate, regardless of the value of their assets. Even if there is minimal cash in their bank account, the legal way to get those monies to their next of kin or beneficiaries is through Probate Administration. Complications can arise years later if an estate was not probated properly, especially when property is involved.

What is the process?

Initiating the Process: The probate process typically begins by filing a petition, the PC-200, with the probate court in the district where the deceased resided. The person who files this petition should be the named Executor or a close relative if there was no will.

Identifying the Fiduciary and Heirs: If there is no will, a Probate Court hearing may be held for all interested parties to appear and review the petition. The Probate Court will appoint an Administrator for the Estate if there is no will appointing one, which may or may not be the person who filed the PC-200. This Fiduciary position is critical to the fair, equitable, and legal administration of the decedent’s estate.

Identifying and Valuing Assets: The executor’s first task is to complete an inventory, the PC-440, of the decedent’s assets, including real estate, bank accounts, investments, personal belongings, and more within two months of their passing. It is crucial to obtain professional appraisals, if necessary, to determine the accurate value of these assets. Protecting these assets, such as maintaining insurance and paying utilities at a home are critical to protecting the Estate.

Paying Debts and Taxes: Identifying and notifying creditors and validating their claims is the next process. A Notice to Creditors must be published in the town paper. The fiduciary must ensure that all valid debts and taxes owed by the estate are paid before distributing assets to beneficiaries. This includes filing the final income tax return and estate tax return, if applicable.

Sale of Real Estate: The probate court may have to approve the sale of property if the deed is not in survivorship, or the will does not specifically allow for the sale of assets. This step is often missed and can delay the closing and risk losing the buyer if a qualified attorney does not assist in this process.

Estate Distribution: After settling all debts and taxes, you will need to file a final accounting (PC-242 or PC246) with the Probate Court. Upon approval by the court, the executor may distribute the remaining assets to the beneficiaries according to the terms of the will or per Connecticut’s intestacy laws (if no will exists). It is essential to follow the court’s guidelines and obtain approval for distribution of estate assets. It is recommended to do this with the assistance of an attorney since the fiduciary takes on legal responsibility for the accuracy of the estate and the financial distributions.

Closing the Estate: Once all debts are settled, taxes paid, and assets distributed, the fiduciary of the estate files the Affidavit of Closing (PC-213) with the Probate Court. Upon reviewing the Affidavit of Closing and verifying that all legal requirements are met, the court accepts and orders the affidavit recorded, which closes the estate and the duties of the executor are complete.

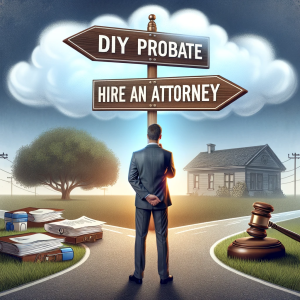

Challenges and Considerations: Probate can be a time-consuming and confusing process, often taking a year or even longer to complete. There are many additional steps and forms required throughout the Probate Administration process that are not listed above. Timelines begin from the day of the decedent’s passing and some deadlines, such as the filing of the CT-706 or the CT-706NT incur a fee if not properly filed within six months of the day of death.

Seek Professional Assistance: Given the complexities involved, seeking guidance from qualified attorney experienced in probate and estate matters is highly recommended. A knowledgeable attorney can guide you through the entire process, ensuring compliance with Connecticut’s specific laws and regulations, and helping to avoid potential pitfalls or disputes that may arise during probate. Additionally, the need for careful planning, such as creating a comprehensive estate plan, utilizing trusts, or designating beneficiaries on certain accounts, to minimize the assets subject to probate can help your loved ones in the future.

Remember, consulting an experienced attorney specializing in probate and estate matters is crucial to ensure a successful outcome and honor the wishes of your loved ones. The above is not a comprehensive guide to the Probate Administration process.

Disclaimer: The information provided in this blog is for general informational purposes only and should not be considered legal advice. Reading this blog does not create an attorney-client relationship with Doyon & White Law Group, PLLC or its attorneys. We make no warranties regarding the accuracy or completeness of the information. Any reliance on the content is at your own risk. For specific legal advice tailored to your situation, please consult with a qualified attorney. [Doyon & White Law Group, PLLC and its authors are not liable for any damages or losses resulting from the use of this information.